Life is arbitrary, correct? One second all’s fine, and the following, something alarming can make a splash. That is where spouse life insurance comes in. It resembles a security net for yourself as well as your loved ones.

Spouse life insurance is a method for ensuring your family remains monetarily safe in the event that your Life partner dies. It gives cash — called a passing advantage — to assist with covering things like bills, credits, or even only everyday costs. To put it plainly, it’s a method for ensuring life can happen without adding monetary pressure.

Why Is Spouse Life Insurance Central?

Can we just be real for a moment — it is terrible to lose a life partner. However, on top of that profound aggravation, monetary concerns can rapidly stack up. The following are a couple of motivations behind why having disaster Safety for your mate is a brilliant move:

Replacing Income

Does your Mate bring back a check? Assuming this is the case, envision what life would resemble without that pay. Life coverage can stage in to fill that hole, assisting you with taking care of the bills, purchasing food, or saving for the children’s future.

Paying Off Debts

On the off chance that you and your spouse share a home loan, vehicle advance, or Mastercard obligation, those instalments don’t stop when life Grows intense. Safety can assist with selling with these so you don’t need to stress over losing your home or fighting to keep up.

Support for Stay-at-Home Parents

We Must not misjudge the worth of what stay-at-home guardians do. From selling with the children to running the family, their commitments are beyond value. Assuming something happens to them, life coverage can assist with taking care of the expense of childcare or other help.

Covering Funeral Costs

Can we just be real for a moment, memorial services can be costly. The typical memorial service can cost a large number of dollars. Life insurance guarantees you will not need to scramble to track down that cash during an all-around troublesome time.

What Nice of Spouse Life Insurance Must You Grow?

Good, now that we tell why it’s central, let’s dialogue around the two main categories of life insurance you can Grow for your spouse.

Term Life Insurance

This type is pretty straightforward. It covers your spouse for a set passé, like 10, 20, or 30 years. If something happens during that time, the plan pays out. If the term ends and your spouse is still with you, the coverage ends too.

- Why It’s Great

It’s affordable and easy to understand.

- Downside

There’s no payout if the term ends before anything happens.

Everlasting Life Insurance

Everlasting life insurance takes for your spouse’s perfect life. Plus, it comes with a savings-like feature called cash value, which grows over time.

- Why It’s Great

It never expires and can be a financial tool for savings.

- Downside

It’s more expensive than term insurance.

How Do You Preference the Right Plan?

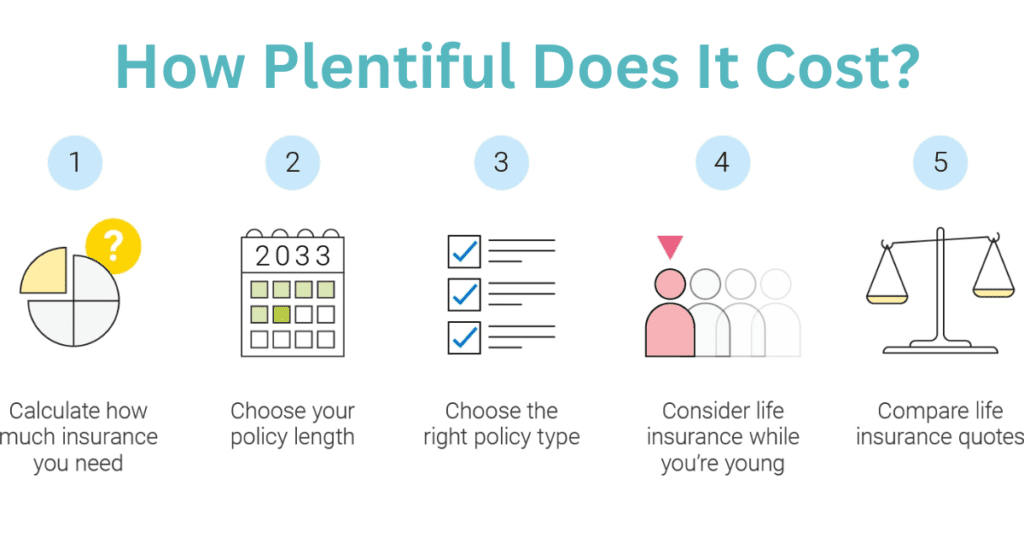

Selecting a life insurance plan power sounds crushing, but don’t worry. It’s calmer than you think. Here’s a stage-by-stage explanation to help:

Figure Out What You Need

Pause for a minute to contemplate your funds. What might you have to cover in the event that your spouse wasn’t there? This could be anything from lease or home loan expenses to putting something aside for your youngsters’ school.

Decide on the Coverage Amount

A good rule of thumb is to Grow coverage that’s 5–10 times your spouse’s annual income. If they don’t have a salary, think about how much it would cost to replace their contributions, like childcare or managing the household.

Set Your BudGrow

Look at what you can manage. Term insurance is regularly cheaper, so it’s a good selection if you’re on a tight budget.

Shop Around

Try not to simply agree to the primary arrangement you see. Contrast statements from various organizations with a view as the best fit.

Grow Advice

Unsure what to pick? Talk with a money-related counsel. They can help you with making heads or tails of your decisions and pick what you truly care about.

How Plentiful Does It Cost?

The expense of spouse life insurance relies upon a couple of things, similar to progress in years, well-being, and the kind of plan. For instance:

- A sound 35-year-old could pay around $20 per month for a term plan with $500,000 in inclusion.

- A Never-ending plan, then again, could cost a lot more.

The good news? There are plenty of options to fit different bud grows.

How Do You Grow Spouse Life Insurance?

The process is pretty simple:

Pick a plan

Decide between term or Everlasting insurance.

Fill Out an Application

You’ll need to share some basic info about your spouse, like their age, health, and lifestyle.

Take a Medical Exam

Some policies require a health check-up, but there are no-exam options if you prefer.

Grow Your Quote

Once everything’s submitted, the insurance company will give you a price.

Start Your Plan

Once you’re happy with the details, sign the plan and you’re all set.

What about Life Changes?

Life happens, and your insurance Must keep up. Perhaps you’ve had a child, purchased a house, or changed positions. In any event, survey your arrangement consistently to ensure it meets your requirements.

Quick FAQs about Spouse Life Insurance

- Can I Grow insurance for a stay-at-home spouse?

Absolutely! Even if they don’t earn a paycheck, their work at home has financial value. - What if we Grow divorced?

You can usually keep the plan, but it’s a good idea to review your options. - Is the coverage from my job enough?

Probably not. Employer coverage is often limited, so it’s smart to have additional insurance.

Final Thoughts

Growing spouse life insurance might not be the most fun thing to think about, but it’s one of the most central. It’s all around Safety the people you love and making sure life can go on, even when the unexpected happens.

Find an opportunity to investigate your choices. Whether it’s term or long-lasting, there’s an arrangement out there that meets your requirements and financial plan. Trust me, whenever it’s finished, you’ll feel a gigantic weight lifted realizing you have your family’s forthcoming covered.

Conclusion

Spouse life insurance isn’t simply a monetary item — it’s a guarantee to safeguard your friends and family when life veers off in a strange direction. It guarantees that your family’s impending remaining parts are steady, in any event, during testing times.

By understanding your options, assessing your needs, and Selecting the right coverage, you’re taking a big stage toward peace of mind. Whether it’s replacing income, covering debts, or simply giving you security, spouse life insurance is a gift of love and responsibility.

FAQs

spouse life insurance What is?

Spouse life insurance is a sort of life insurance that gives money-related Prosperity to your Buddy in case of their end. It helps cover costs, supplant lost pay, and keep up with monetary solidness for the enduring relatives.

Why do I need spouse life insurance?

Spouse life insurance is fundamental for the Security of your family’s monetary future. It can supplant pay, take care of obligations, cover memorial service expenses, and assist with supporting stay-at-home guardians, giving genuine serenity during troublesome times.

What is the category of spouse life insurance?

There are two main categories:

- Time Life Insurance:

Offers inclusion for a particular old-fashioned (e.g., 10, 20, or 30 years). It’s affordable but expires after the term ends.

- Everlasting Life Insurance:

Gives lifetime inclusion and incorporates an investment funds part that forms cash esteem over the long haul.

How much companion life coverage inclusion do I want?

Specialists suggest having inclusion that is 5-10 times your mate’s yearly pay. In the event that they don’t procure compensation, think about the worth of their commitments to the family, like childcare and family the board.

Keyword

Life Insurance

Spouse Life Insurance