Life can be unsure, and not complete shocks are good ones. Health crises can pop up out of nowhere, bringing stress, worry, and great bills. That’s where health insurance comes in. It’s like a safety net for you and your family when times get strong.

And in today’s world—with globals, rising medical costs, and economic unsureness—health insurance is more important than ever.

What is Health Insurance?

Health insurance is lovely and simple. You pay a monthly or annual amount called a premium, and your insurance company helps handle your medical costs. This can participate visits to the doctor, hospital stays, medicines, and even check-ups to keep you healthy. It’s there to make sure you can get the safekeeping you need without unloading your savings.

Why Health Insurance Matters

safe Your Wallet

Let’s face it: the medical amount due can be sky-high. A solitary outing to the medical clinic can cost thousands. With health insurance, you don’t have to pay completely that out of pocket. It helps handle the great material so you can focus on getting excellent.

Getting Quality Care

Having health insurance often means you’ll have entry to excellent doctors and hospitals. Many plans have networks of trusted health safe keeping ofried. This means you’ll get good safekeeping when you need it.

Inhibitory safekeeping is a plus.

Did you know that almost all health insurance plans offer free check-ups, Drawbacks, and screenings? These services can catch problems early or even stop them from happening. Staying healthy is always the best option.

Help for Mental Health

Taking safekeeping of your brain is just as important as taking safekeeping of your bodywork. Many health insurance plans now participate in handling therapy and Advice. This can be a great help, specially during stressful times.

Peace of brain

Knowing you’re handled in case of an exigency can ease a lot of stress. It’s one less thing to worry around when life throws you a curveball.

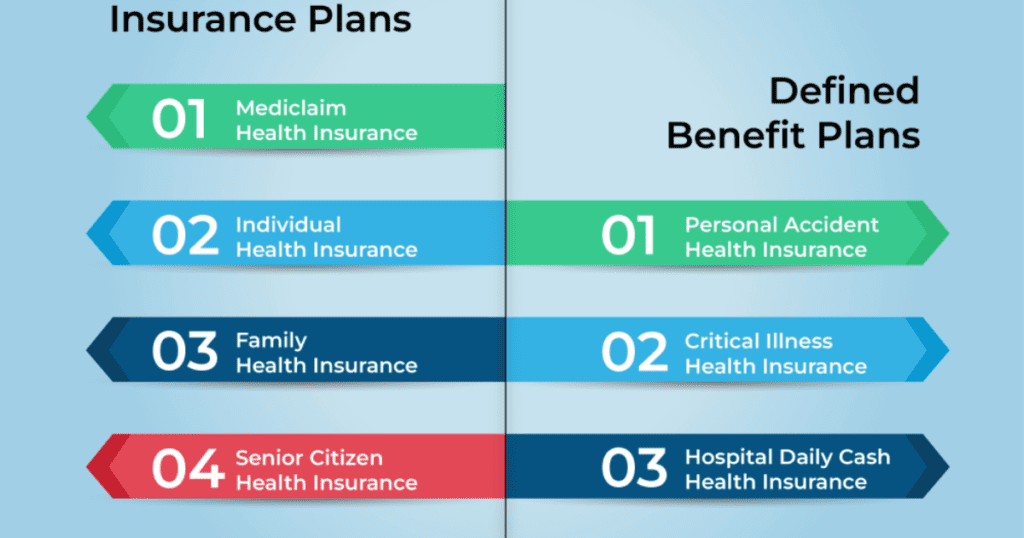

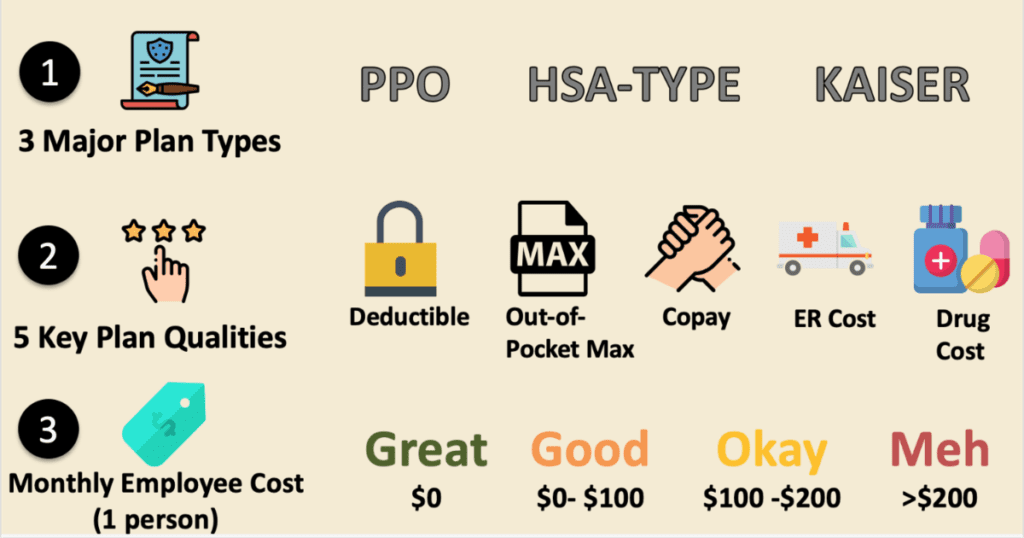

dissimilar Types of Health Insurance

Not complete health insurance plans are the same, so it’s important to pick one that works for you. Here’s a fast analysis:

single Plans

These are for one person. If you’re a self-worker or don’t get insurance from work, this might be for you.

Family Plans

These handle your whole family under one plan. They’re a good option if you want to make sure everyone’s taken safekeeping of.

Workplace Insurance

A lot of companies offer group health insurance to employees. It’s usually more affordable than buying a plan on your own.

Critical Illness handling

This type of insurance gives you a lump amount if you’re identified with a crucial illness like cancer or a heart attack. It can help handle treatment costs and other cost.

Senior resident Plans

These are designed for older adults and often handle age-related health issues and pre-existing conditions.

How to Select the Good Plan

Picking a health insurance plan might seem excellent, but it doesn’t have to be. Here are a few tips:

What’s handled?

Make sure the plan includes the basics like hospital stays, medications, and doctor visits. Some plans even offer extras like maternity safekeeping or dental services.

Check the Network

Look for a plan that works with hospitals and doctors you trust. Having a good network makes things easier.

Compare Costs

Balance the monthly premium with what the plan handles. Sometimes paying a little more each month can save you great bucks later.

Read the Reviews

Check out what other people are saying around the insurance company. A simple and fast claim process can make a huge difference.

Watch Out for keeping out.

Every plan has things it doesn’t handle. Make sure you know what those are so there aren’t any surprises.

Why Health Insurance is Crucial During a Global

The COVID-19 global showed us how quickly life can change. Families faced suddenly medical bills, and many realized the value of health insurance. Some companies even created special policies to handle COVID-related costs. Health insurance manifests to be a lifesaver for many.

Common Misunderstandings Around Health Insurance

There are some myths out there that stop people from getting insured. Let’s clear those up:

I’m Healthy, So I Don’t Need It

Even if you’re in great shape, accidents or sudden disorders can happen. It’s excellent to be prepared.

It’s Too Expensive

There are plans for every budget. Additionally, the expense of not having protection can be a lot higher.

Claims Are a Hassle

Many insurers now offer easy, online claim activity. They’re designed to be fast and straightforward.

Pre-Existing Conditions Aren’t handle

almost all plans handle pre-existing conditions after a waiting period. Don’t let this stop you from getting insured.

Tips to Make Almost All of Your Plan

To get the best out of your health insurance, keep these tips in your brain:

Know Your Plan

Take some time to read through your plan. Understanding what’s handled will save you from shock later.

Use Free Check-Ups

Many plans offer free inhibitory care. Don’t skip those annual health check-ups!

Stick to the Network

Involving in-network specialists and emergency clinics can set aside your cash.

File Claims Quickly

If you need to make a claim, do it good away. Keep complete the paperwork ready to speed up the process.

Review Your Plan Often

Life changes and your insurance should keep up. Ensure your arrangement actually meets your requirements.

Conclusion

Health insurance is more than a financial tool—it’s a way to safely your upcoming and ensure peace of brain. Life’s Suddenly makes it necessary to have a solid plan in place for both minor health concerns and major emergencies.

Whether it’s a routine check-up or an sudden hospital visit, having health insurance means you’re Ready for life’s twists and turns. Beyond the financial support, it offered entry to quality health safekeeping and inhibitory services, helping you stay ahead of potential health issues.

In today’s world, where medical costs are rising and health risks can appear suddenly, investing in the good health insurance plan is not just smart—it’s necessary. Take the time to explore your options, understand your needs, and select a plan that offers the safe and profit you justify.

With health insurance, you’re not just safe your finances; you’re fixed a healthier, more confident upcoming for yourself and your loved ones.

FAQs

What is health insurance?

Health insurance is a plan where you pay a premium, and your insurance company helps handle medical costs like doctor visits, hospital stays, medications, and inhibitory care. It ensures you can enter quality health safekeeping without financial strain.

Why do I need health insurance?

Health insurance safe your finances by handling costly medical costs offers entry to quality care, supports inhibitory healthcare, and offers peace of brain during emergencies.

What are the main types of health insurance?

Health insurance comes in various forms, including single plans, family plans, workplace insurance, critical illness handling, and senior resident plans. Each serves dissimilar needs and budgets.

How do I select the good health insurance plan?

Consider what’s handled, check the offered network, balance premiums with profit, read reviews for claim activity, and review keeping out to find the best fit for your needs.