When it comes to the safety of your family’s financial upcoming, life insurance is one of the smart ends you can make. But with so many selections out there, Estimating the good fit for your needs can feel excellent.

Two usual selections persons many a time Please pay attention. Are spouse life insurance and Personal life insurance? Equally have their profits, but they help change Objectives, and Understanding the key changes is Important.

Spouse life insurance is many a time offered as an add-on to a main plan, usually through work. It’s a cheap and easy way to offer some financial safety for your spouse.

On the other hand, Personal life insurance is a Action plan Developed by specially to your needs, offering more perfect and elastic handling.

In this leader, we’ll pause down the profit and lost of each, explore how they work, and help you choose which selection (or mixture of equally) is the good choice for your family.

Whether you’re planning for a short time or thoughtful in advance for years to come, we’ll make it easy to know your selections so you can make a Notification decision.

First Things First: What Is Life Insurance?

At its core, life insurance is around the safety of the persons you love. If A few happen to you, life insurance helps your family cover important costs like rental, resident costs, or even your kids’ college Academy.

It’s around create confirm they’re okay financially, even if you’re not there to offer to them.

Spouse Life Insurance: What’s the Deal?

Spouse life insurance is usually a few you add to your plan or get through work. It’s meant to cover your spouse if a few happens to them.

Think of it as a little extra safety that’s tied to a main life insurance plan—usually yours.

Here’s the thing: spouse life insurance tends to be basic. It’s easy and many a time cheaper, but it’s not designed to cover large, long-time needs like paying off a house or securing your family’s upcoming for decades.

What around Personal Life Insurance?

Now, Personal life insurance is like the customizable, build-your-own-burger selection of the life insurance world. You buy it directly for yourself, and you can choose how much handling you need, for how long, and who gets the payout.

It’s a plan that’s all around you. Whether you’re looking for handling that lasts 10 years, 30 years or your whole life, a Personal plan gives you that freedom.

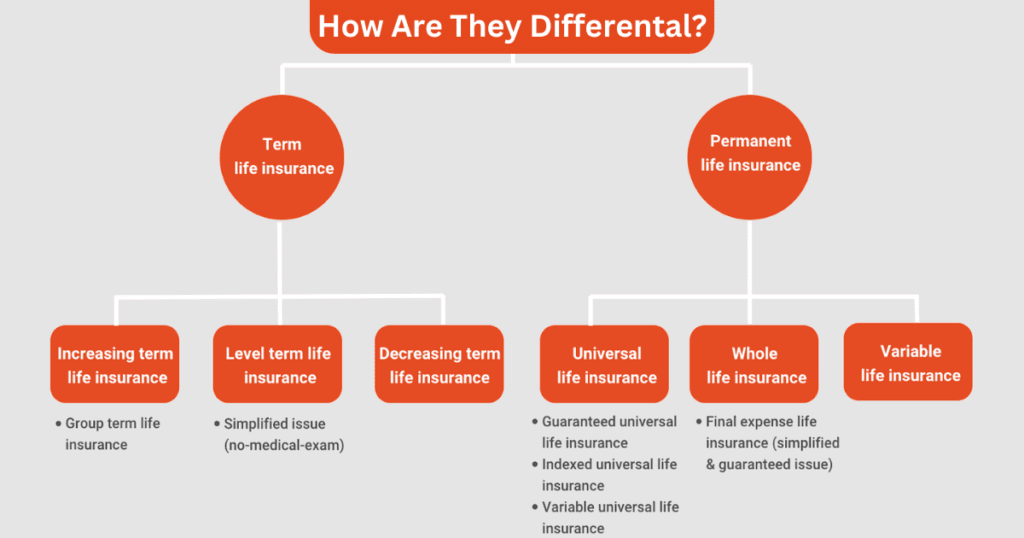

How Are They Differental?

Okay, so now let’s compare spouse life insurance and Personal life insurance side by side.

handling volume

- Spouse Life Insurance

You’re looking at A little volume—usually among $10,000 and $100,000.

- Personal Life Insurance

Way more customizable. You can get handling in the millions if that’s what your family needs.

Flexibility

- Spouse Life Insurance

It’s tied to the main plan or a group plan (like the one from your job). If you or your spouse leaves that job, the handling might end.

- Personal Life Insurance

Completely yours. It stays with you no matter where you work or live.

Cost

- Spouse Life Insurance:

It’s usually cheaper upfront because the handling is A little and doesn’t require a health exam.

- Personal Life Insurance

Costs vary depending on your age, health, and how much handling you want, but it gives you more bang for your buck in terms of protection.

Medical Exams

- Spouse Life Insurance

many a time doesn’t require one. Super convenient!

- Personal Life Insurance

Usually requires some health checks, but this helps the insurer give you a personalized rate.

When Is Spouse Life Insurance a Good Idea?

Spouse life insurance is great if you’re looking for a few quick and easy. Maybe you already have a plan through work, and adding your spouse to it just makes sense.

It’s also a solid selection if you’re on a tight budget and need some handling, even if it’s not a lot. Think of it like a safety net—good to have but not a full-on financial plan.

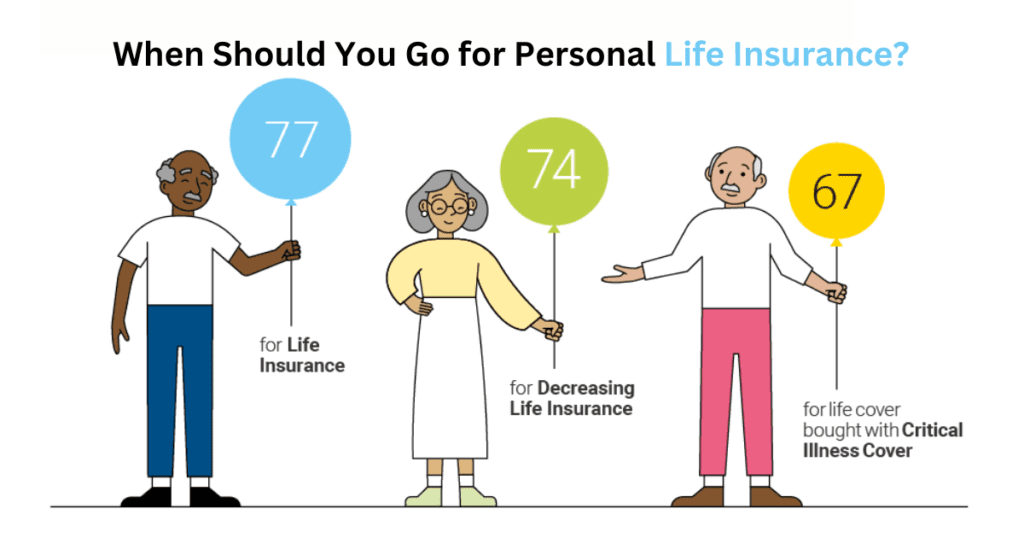

When Should You Go for Personal Life Insurance?

Personal life insurance is the way to go if you want full control and enough handling to really take care of your family. It’s perfect for larger financial goals, like paying off a resident or saving for your kid’s upcoming.

Plus, it sticks with you no matter what. Quit your job? Move to a new city? No problem—your plan comes along for the ride.

Can You Have equally?

Absolutely! Many persons use spouse life insurance as a supplement to a Personal plan. Think of it like layering clothes in winter—more handling means more protection.

If your budget allows, combining the two gives you Equal convenience and long-time security.

Let’s Talk around What Really Matters

Choosing among these selections isn’t just around the policies—it’s around you and your family. Yourself Here are a few questions to ask:

What does my family need?

Do you have a resident, kids, or other large financial Duties? If so, you might need more handling than spouse life insurance provides.

What’s my budget?

Spouse life insurance can be a budget-friendly way to get some handling in place quickly. But if you can afford a bit more, Personal insurance offers way more flexibility.

Am I thoughtful short-time or long-term?

Spouse life insurance is great for short-term or supplemental needs. Personal insurance is better for long-time planning.

Conclusion

Choosing among spouse life insurance and individual life insurance comes down to your family’s specific needs, budget, and long-term goals. Spouse life insurance is an easy and cheap way to get basic handling for your spouse, especially if you’re adding it to a group plan through work. It’s great for short-term needs or as a supplement to other handling.

Individual life insurance, however, offers greater flexibility and long-term security. It’s an Action plan that stays with you no matter where you work or live.

With developed handling limits and desired times, it’s a good choice for making sure your family’s financial Peace for years to come.

You don’t have to choose just one. Many persons Together spouse life insurance with individual plans to create a stable plan that meets fast and upcoming needs.

Take the time to Amazing your financial situation, your family’s goals, and the type of handling that makes the most sense for you. Whatever you agree, Keep in mind that taking some form of life insurance is always better than none.

It’s an important step toward the safety of the persons you love and To give yourself peace of mind.

FAQs

What is the main difference among spouse life insurance and Personal life insurance?

Spouse life insurance is typically an add-on to a main plan, offering limited handling for your spouse, many a time through an employer. Personal life insurance is an Action plan that provides customizable, long-time handling tailored to your needs.

Is spouse life insurance cheaper than Personal life insurance?

Yes, spouse life insurance is usually cheaper because it offers A little handling volume and doesn’t require a medical exam. Personal life insurance might cost more but provides higher and more perfect handling.

What happens to spouse life insurance if the main planholder changes jobs?

Spouse life insurance is tied to the main planholder’s group plan, many a time provided by an employer. If they leave their job, the handling usually ends unless there’s a selection to convert it to a Personal plan.

Can I have Equal spouse life insurance and Personal life insurance?

Yes! Many persons use spouse life insurance as a supplement to a Personal plan, combining the affordability of one with the perfect handling of the other.

How much life insurance handling do I need?

A good law of thumb is 10–15 times your annual earnings. However, this Depends. On sections like your Borrow, family cost, and upcoming financial goals.