Life insurance is around more than only financial safety —it’s around peace of brain. Open Care Life Insurance offers an easy, cheap way to safe the persons who matter mostly ly to you. Whether you’re planning for the upcoming or looking to cover fast costs, Open Care makes it simple to find a plan that fixes your needs. With quality like budget-friendly premiums, no fitness exams, and guaranteed taking for seniors, it’s clear why so many persons trust them. Let’s explore what makes Open Care Life Insurance stand out.

Life insurance is one of the mostly ly important financial products you can invest in to safe your loved ones and secure their future. Open Care Life Insurance makes it simple and cheap, so you can feel confident knowing your loved ones are taken care of. Let’s break down some of the key qualities that make Open Care Life Insurance a great selection.

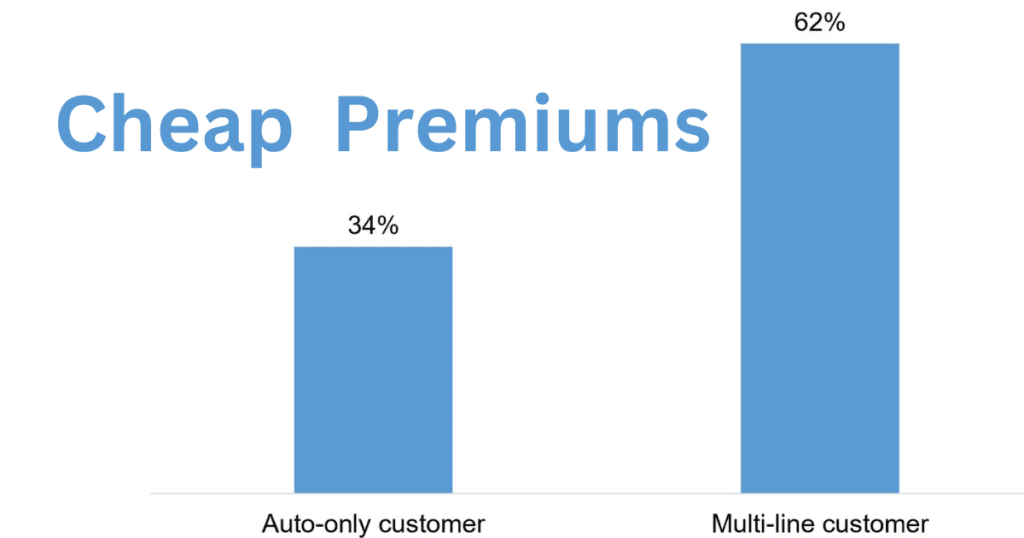

Cheap Premiums

We all want to get the mostly ly value for our money, right? Open Care Life Insurance keeps premiums budget-friendly so you don’t have to tension around costs. Whether you’re working with a hard financial plan or only want a great deal, there’s likely an option that works for you.

No Fitness Exam Needed

Hate the hassle of doctor visits? You’re in luck. Open Care offers plans that skip the fitness exam. This makes applying a breeze, especially if you have health concerns or only want a quicker process.

Guaranteed Handling For Seniors

If you’re between 50 and 85 years old, Open Care has your back. They offer guaranteed taking policies, so you can get handling no matter your health situation. It’s peace of brain, plain and simple.

Flexible Handling Amounts

Need a small policy for the final cost or something bigger to leave behind for your family? Open Care lets you choose the amount that works best for your situation. You’re in control of what you need.

Quick and Easy Application

Nobody likes complex paperwork. With Open Care, the application process is excellent and simple and approvals happen fast. It’s designed to be tension-free, so you can focus on what matters mostly.

Living Profit

Life can be unpredictable, but Open Care’s living being fixed has you covered. If you’re diagnosed with a terminal illness, you can access part of your plan payout early. This can help ease financial burdens when you need it mostly.

Plans Tailored to You

We all have unique needs, and Open Care gets that. You can customize your policy to fit your financial goals and personal situation. Their team is there to help you create a plan that’s only right for you.

A Trusted Partner

Open Care has been helping families for years, and it’s easy to see why so many persons trust them. They’re known for reliable payouts and excellent customer service—qualities that matter when choosing life insurance.

Why Should You Choose Open Care Life Insurance?

Think of Open Care as more than only an insurance provider—they’re a partner in helping safe your family’s future. Here are a few more reasons why Open Care might be a great fit for you:

- Clear and Transparent Policies

No hidden fees or confusing fine print here. You’ll know exactly what you’re getting.

- Help every Step of the Way:

Open Care’s friendly team is always ready to answer your questions and make the process smooth.

- Solutions That Fit Your Life

Whether you’re youthful, a senior, or somewhere in between, they’ve got a selection for you.

- Financial Peace You Can Count On

With a strong track record, Open Care ensures timely payouts and dependable service.

Conclusion

Life insurance is around more than only financial safety —it’s around peace of brain. Open Care Life Insurance offers an easy, cheap way to safe the persons who matter mostly ly to you. Whether you’re planning for the upcoming or looking to cover fast costs, Open Care makes it simple to find a plan that fixes your needs. With quality like budget-friendly premiums, no fitness exams, and guaranteed taking for seniors, it’s clear why so many persons trust them. Let’s explore what makes Open Care Life Insurance stand out.

Life insurance is one of the mostly ly important financial products you can invest in to safe your loved ones and secure their future. Open Care Life Insurance makes it simple and cheap, so you can feel confident knowing your loved ones are taken care of. Let’s break down some of the key qualities that make Open Care Life Insurance a great selection.

FAQ

What makes Open Care Life Insurance cheap?

Open Care offers budget-friendly premiums designed to fit different financial situations. Whether you’re on a hard financial plan or looking for value, there’s a plan for you.

Do I need to take a fitness exam to be eligible?

No! Open Care Life Insurance offers plans that don’t require a fitness exam. This makes the process quick and hassle-free, especially for those with health concerns.

Can seniors get handled with Open Care?

Absolutely. Open Care offers guaranteed taking policies for individuals aged 50 to 85, regardless of health status. It’s designed to provide peace of brain for seniors.

What handling amounts can I choose from?

You can select from a range of handling amounts, whether you need a small policy for final cost or a larger policy for your family’s financial safety.

How easy is the application process?

The application process is excellent simple and fast. You won’t have to deal with complex paperwork or long wait times.

What are living profits, and how do they help?

Living Bene fixed allows you to access part of your plan’s payout if you’re diagnosed with a terminal illness. This feature helps ease financial burdens during tough times.

Can I customize my policy?

Yes, Open Care offers custom plans to fit your unique financial goals and personal needs. Their team can help you create the perfect policy.

Why is Open Care considered a trusted provider?

Open Care has years of experience, reliable payouts, and excellent customer service. Their reputation for transparency and dependability makes them a top selection.