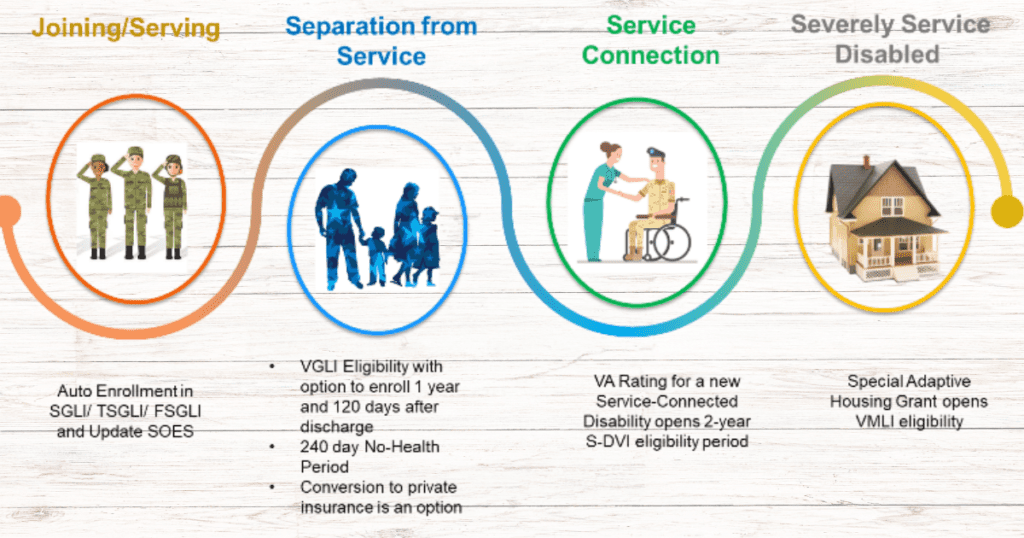

Hey there! Let’s get real for the next—life insurance is hypothetical to be a safety net for your loved ones when you’re no longer about.

But what happens when the insurance company struggles on its feet, stays the charge, or rejects the right outright? That’s where a life insurance lawyer in us can stage in and make things right.

If you’re selling with this kind of pressure, you’re not single. It’s annoying, it’s one-sided, and lawfully, it’s not something you should have to hold on your own.

Let’s dump into what life insurance lawyers do, why Rights get different, and how you can get the succour you need to Fight back.

So, What Does a Life Insurance Lawyer Do?

Think of a life insurance lawyer as your guide through the messy world of insurance Rights. They’re the ones who stage in when things go south—like when your right is different, late, or stuck in some never-ending loop of paperwork.

Here’s how they can succeed:

- Fixing take-backlights:

If the insurance company says “no” to your claim, they’ll dig into why and fight for your charge.

- Speeding Up Late costs:

Sometimes insurers take their sweet time. A lawyer can light a fire under them.

- Handling Family Disputes:

If there’s a disagreement over who gets the money, they’ll sort it out.

- Stopping one-sided Practices:

If the insurance company is acting shady (like rejecting your rights for no good reason), a lawyer can hold them accountable.

Why Do Life Insurance Rights Get Different?

You’d think that if someone paid their premiums, the care would be a done deal. Unluckily, that’s not always the case. Here are some common reasons Rights get take-back(and don’t care, they’re often fixable):

There’s a Mistake in the Application

This happens when the policyholder accidentally gives incorrect info when they scribble up—like failing to recall to reference a fitness condition.

Insurance companies love to involve this as a Reason.

The plan Lapsed

If premiums weren’t paid off on time, the insurance company might cancel the plans. But here’s the thing: sometimes they’re incorrect, and a life insurance lawyer can succour prove it.

It’s Still Within the Contestability date.

In us, if the policyholder passes away within the first two years of getting the policy, the insurance gets extra nosy. They’ll comb through everything to find a reason not to pay.

Plan Exclusions Apply

Some plans don’t refuge certain types of expiries, like Suicide within the first pair of years or high-risk actions like jumping. It’s total in the Discover print.

There’s a Fight Over Who Gets the Cash

If there is more than one people requesting to be the correct beneficiary, the insurance company might stop the care until the matter is fixed.

How Can a Lawyer succour You?

Alright, so you’re selling with a take-back or late claim—what now? Here’s where a life insurance lawyer comes in handy:

They’ll Read the Fine Print for You

Insurance plans are full of legal jargon. A lawyer can break it down and figure out what’s going on.

They’ll Investigate

Sometimes the denial is based on unfinished or incorrect information. Legal advisors can assemble the proof expected to sort things out.

They’ll Negotiate

Insurance companies tend to take things more seriously when a lawyer is involved. It’s like having a heavyweight in your corner through a fight.

They’ll Take It to law court (If Needed)

If the insurance still won’t budge, a lawyer can file a lawsuit to get what you’re paying. And don’t care—many lawyers only get paid if you succeed.

They’ll hold a Family Drama.

Disputes over beneficiaries can get messy. A lawyer can make sure the money goes to the right person.

Why Our Laws Matter (And Why You Need a Local Lawyer)

Us has its own set of rules when it comes to life insurance. Knosucceedg these laws can make or break your case. For example:

- Insurers Have a Deadline:

In us, insurance companies are hypothetical to pay Rights within 30 to 60 days. If they drag their feet, they could be in violation of the law.

- The Contestability dated:

Through the first two years of a policy, insurers can dig deep into the claim. But they still have to follow the rules.

- Bad Faith Practices Are Illegal:

If an insurance company is acting one-sidedly—like rejecting your right without a good reason—you might be entitled to extra compensation.

A US-based lawyer knows these laws inside and out, which is why having someone local on your side is a huge plus.

What to Do If Your Right is Different

If your rights have been different, don’t give up. Here’s a game plan to succour you fight back:

Read the Denial Letter

Insurance companies have to explain why they’re rejecting your claim. This letter is your starting point.

Collect Your Documents

Gather everything—your policy, payment receipts, emails with the insurer, medical records, and anything other that might succour your case.

Conversation with a Lawyer

A life insurance lawyer can analyse your case and let you know if you’ve got a potshot (spoiler watchful: you possibly do).

Application the Choice

Most insurers have an appeals process. A lawyer can guide you through it and succour make your argument stronger.

Consider Legal Action

If all other losses, your lawyer can take the case to a law court. Sometimes just filing a lawsuit is plentiful to make the insurance company back down.

How to Explore the Right Lawyer for You

Lifting the right lawyer can feel like a big choice, but it doesn’t have to be pressure. Here are some tips:

- Look for Experience:

Make sure they’ve handled life insurance cases before.

- Check Reviews:

See what other clients have to say.

- Ask About Fees:

Many lawyers only get paid if you succeed. Double-check this before signing anything.

- Schedule a Free conference:

Most lawyers offer this. It’s a chance to ask requests and see if they’re a decent fit.

Let’s go Wrap This Up

selling with a take-back or late life insurance right can be overwhelming, especially when you’re already selling with a loss. Be that as it may, you don’t need to go through it single.

A life insurance lawyer can take the pressure off your shoulders and fight to get you the care you deserve.

If this is something you’re going through, don’t wait. Reach out to a lawyer today for a free conference.

They’ll listen to your story, explain your options, and help you move forward. You have this — and they have you covered.

Life Insurance Lawyer us | $100M in Insurance Rights: What You Need to Know

Life insurance offers financial safety for loved ones after someone passes away. But what happens when a right is taken back or late? If you’re in us and facing issues with a life insurance claim, hiring a skilled life insurance lawyer can make a significant difference.

With over $100 million in Rights improved for clients, these legal professionals have the expertise to succour you get the profits you deserve.

In this guide, we’ll explain what a life insurance lawyer does, common rights issues, and how to protect your rights. Whether your right has been different, late, or reversed, this article will give you the tools to take the next stage.

Life Insurance Lawyer What Does a Do?

A life insurance lawyer specializes in succoring clients resolve issues with insurance Rights. They hold cases where beneficiaries face problems such as:

- Right denials:

Insurance companies may junk to pay a right for various reasons.

- Late charges:

Rights can be stalled due to lengthy investigations or administrative issues.

- Beneficiary disputes:

Conflicts between family members over who should receive the profits.

- Bad faith practices:

Insurers may act one-sidedly by rejecting or delaying a right without a valid reason.

In us, these attorneys are well-versed in state laws governing life insurance plans.

They know how to work out with insurance companies and, if compulsory, take cases to the law court to ensure customers receive fair treatment.

Common Reasons Life Insurance Rights Are Different

Insurance companies don’t always approve Rights, even when beneficiaries believe they are valid. Here are some of the most common reasons Rights get different:

Misrepresentation on the Application

If the policyholder offers incorrect or unfinished info through the application process, the insurance might deny the claim.

For example, failing to disclose a pre-current medical state could result in rejection.

Lapsed plans

Life insurance plans need daily premium costs. If the policyholder misses costs and the plan lapses, the insurance company may junk to pay.

Contestability dated Issues

In us, insurance companies can investigate Rights more closely if the policyholder dies within the first two years of the policy. This is identified as the “contestability dated.” If they find differences, they may deny the claim.

Plan Exclusions

Some plans exclude certain causes of death, such as suicide within a specific time frame or expiries related to risky actions like jumping. If the cause of death falls under these exclusions, the rights may be different.

Beneficiary Disputes

If multiple parties right to be the correct beneficiary, the insurance company may delay or deny payment until the dispute is fixed.

How a Life Insurance Lawyer Can succor

When a right is taken back or late, navigating the process single can be overwhelming. A life insurance lawyer can offer valuable assistance by:

Reviesucceedg Your Policy

An attorney will carefully examine the terms of your plan to understand your rights and the insurer’s obligations. This ensures you know whether the denial or delay is justified.

Investigating the Claim

Lawyers gather evidence to support your case, such as medical records, payment history, and correspondence with the insurer. They aim to identify any errors or one-sided practices.

Negotiating with the Insurer

Insurance companies often respond more effectively when selling with a legal professional. Lawyers use their expertise to push for a fair resolution.

Filing a Lawsuit

On the off chance that exchanges fizzle, your legal counsellor can take the protection to a regulation court. This is especially important in cases involving bad faith practices, where insurers may face additional penalties.

Resolving Beneficiary Disputes

Attorneys succour beneficiaries navigate conusicts, ensuring the correct people receive the profits.

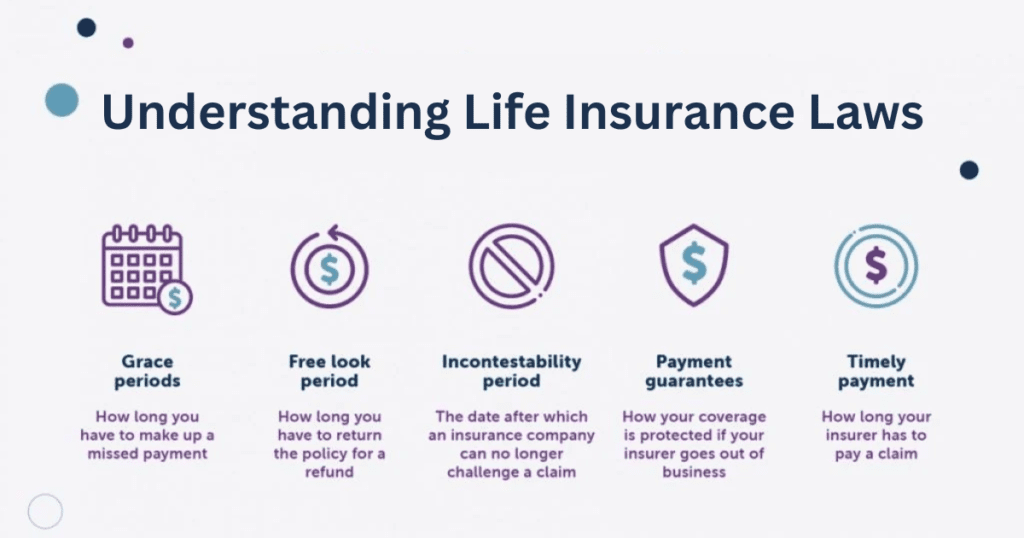

Understanding Life Insurance Laws

Has specific laws that protect policyholders and beneficiaries. Here are a few critical viewpoints to remember:

Time Limits for charges

Us law requires insurance companies to pay Rights within a reasonable time, typically 30 to 60 days after receiving all necessary documents. Stays beyond this date may be considered bad faith.

Contestability dated

As mentioned earlier, insurers can contest Rights within the first two years of a policy. However, they must have valid reasons and offer evidence for their findings.

Bad Faith Insurance Practices

In us, insurers must act in good faith when handling Rights. If they deny or delay a right without justification, beneficiaries can file a lawsuit for bad faith practices.

This can lead to additional compensation beyond the policy’s value.

Safety Against Fraud

Our law also protects insurance companies from fraudulent Rights. If fraud is suspected, the insurance may investigate extensively before paying out.

Stages to Take If Your Life Insurance right Is different

If your life insurance right has been different, don’t panic. Follow these stages to protect your rights:

Analyse the Denial Letter

The insurance company must offer a written explanation for rejecting your claim. Read it carefully to understand their reasoning.

Gather Documentation

Collect all relevant documents, including the policy, payment records, medical reports, and correspondence with the insurer. These will be essential for building your case.

Meeting a Life Insurance Lawyer

Checking a lawyer as soon as thinkable can increase your chances of victory. They will analyse your case and guide you on the best course of action.

Application the Denial

Most insurers have an appeals process for take-backRights. Your lawyer can succor you prepare a strong Application and negotiate with the insurer.

File a Lawsuit if Necessary

If the insurance junk is to cooperate, your lawyer can take legal action. This may involve filing a lawsuit for breach of contract or bad faith practices.

How to Select the Correct Life Insurance Lawyer in Us

Choosing the right lawyer is crucial for the victory of your case. Here are some tips for discovering the best advocate for your needs:

Look for Experience

Choose a lawyer with extensive experience handling life insurance cases in us. Their knowledge of state laws and previous victories will benefit your case.

Check Reviews and Testimonials

Read reviews from past clients to get a sense of the lawyer’s reputation and level of service.

Ask About Fees

Many life insurance lawyers work on a contingency fee basis, meaning you only pay if they succeed in your case. Ensure you comprehend their charge structure before continuing.

Schedule a conference

Most lawyers offer free conferences. Use this opportunity to ask questions, assess their expertise, and determine if they’re the right fit.

Conclusion

selling with a take-back or late life insurance lawyer right can be pressureful, especially through an already difficult time. A life insurance lawyer in us can succor you navigate the process, fight for your rights, and improve the profits you’re entitled to. With over $100 million in Rights improved, these professionals have the expertise to deliver results.

If you’re facing matters with a life insurance claim, don’t wait. Contact a reliable life insurance lawyer today for a free conference. Protect your rights, save your future, and confirm your loved one’s wishes are honoured.

FAQs

What does a life insurance lawyer do?

A life insurance lawyer helps you resolve matters with your insurance claim, such as retractions, stays, or clashes. They analyse your plans, gather suggestions, thrash out with the insurance company, and even take legal action if needed to confirm you get the care you deserve.

Why would a life insurance right be different?

Rights can be take-backfor reasons like errors on the application, a lapsed plan due to missed costs, or the death occurring through the contestability dated (the first two years of the policy).

Insurers may also deny Rights based on exclusions in the policy, such as certain causes of death, or due to disputes between beneficiaries.

What is the contestability dated in us?

In us, the contestability date goes on for the initial two years after a life insurance plan is given. Through this time, insurance companies can closely investigate Rights and deny them if they find differences, such as incorrect info on the application.

Can I still get my care if my right was different?

Yes! A take-backright doesn’t mean the case is closed. Many denials can be appealed victoryfully with the succour of a life insurance lawyer. They’ll analyse the denial reasons, collect evidence, and fight for your correct profits.

Key Word;

life insurance lawyer

life insurance