Selecting a good health insurance plan can feel like a great, unclear task. With so many Selecting out there, it’s easy to get beset. But don’t worry — we’re here to break it all down for you.

By following a few simple steps, you can find a plan that fixes your needs and financial plan. So, take a look at how to compare health insurance plans in a strategy that makes feeling and doesn’t pressure you out.

Start by Thinking about Your Health Safety Needs

Before you dive into comparing plans, allow yourself some time to think about your Health Insurance safety needs. Everyone’s health is dissimilar, so it’s Chief to figure out what works well for you. Here’s what to consider:

How’s your health?

Are you generally healthy, or do you have a situation that needs well-organized safety, like diabetes or asthma? This will assist you in knowing if you need a plan with a lot of handling or if something more primary will work.

Do you take medications?

If you do, you’ll want to make sure that your plan handles the instruction you need.

How many times do you see a doctor?

Do you come to see the doctor once a year for check-ups, or do you see a professional more often? If you’re planning on well-organized visits, it’s Chief to pick a plan that handles those costs well.

Do you have any upcoming procedures or treatments?

If you’re thinking about having surgery or getting a handling of soon, make sure it’s handled by the plan you’re needed at.

Once you have a proposal of what category of safety you might need, you’ll be in an excellent place to compare the Selecting available.

Get Familiar with Common Health Insurance Time.

Health insurance plans can be full of unclear time, but don’t let that safety you off! Once you recognize a few primary words, it’ll all make sense. Here’s a fast analysis:

- Premium

This is the quantity you pay every month to have insurance. It’s like a membership fee that keeps you handled.

- Deductible

This is the amount you actually want to pay personally before your safekeeping starts assisting with costs. For instance, on the off chance that your futility is $1,000, you’ll have to pay the first $1,000 of your well-being receipt before the safekeeping kicks in.

- Copay

A copay is an excellent amount you pay when you come to see the specialist or get guidance. For example, you might pay $20 for a doctor’s visit, while the insurance handles the relaxation.

- Coinsurance

This is a percentage of the cost you’ll pay for services after your superfluity is met. For instance, in the event that you actually want a strategy and your coinsurance is 20%, you handle 20% of the invoice, and the safekeeping handles 80%.

- Out-of-Pocket Maximum

This is the speedy you’ll pay in a year for handle services. Once you hit this amount, the insurance pays for everything else.

Getting familiar with these times will assist you in recognizing how each plan works and what to expect when it comes to costs.

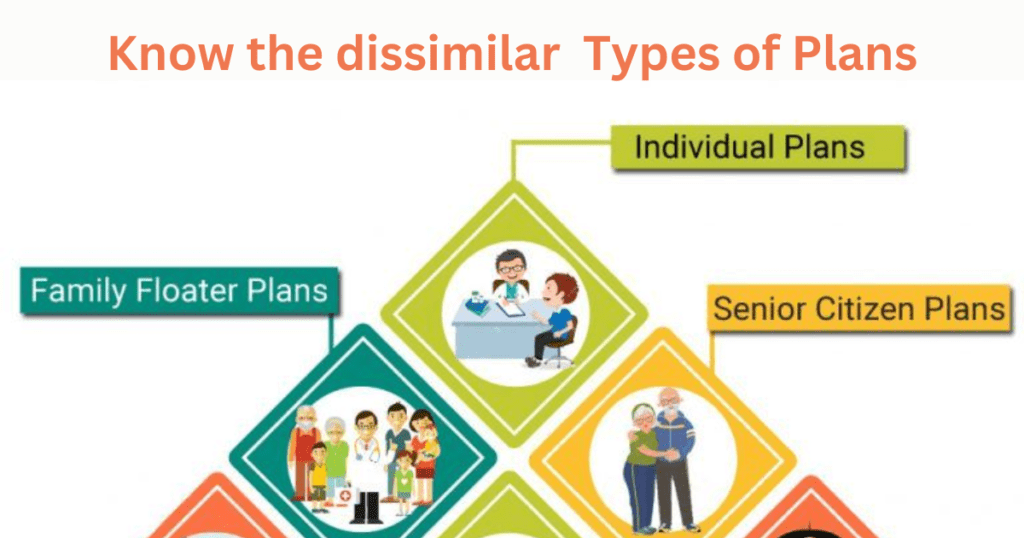

Know the dissimilar Types of Plans.

There are a few dissimilar types of health insurance plans, and each one offers dissimilar levels of elasticity and cost. Here’s a fast failure:

- HMO (Health safe keeping Organization)

These plans as a rule have an organization of specialists and clinical focuses that you’ll have to utilize. You ordinarily need to get a reference from your essential well-being specialist to see a specialist.

- PPO (Preferred offered Organization)

PPO plans offer greater adaptability. You can see any specialist, regardless of whether they’re in the organization, yet you’ll pay more assuming you leave the organization.

- EPO (special offered Organization)

EPO plans are like PPOs but don’t handle any out-of-network safety unless it’s a crisis.

- POS (Point of Service)

These plans combine factors of HMO and PPO plans. You might need a referral to see an expert, but you can also see out-of-network offered at a great cost.

Selecting a good type of plan depends on how much elasticity you want and what category of safety you need. If you want more control over which doctors you see, a PPO might be the strategy to go. But if you’re needed for a more financial plan-friendly option, an HMO could work better.

Compare Costs: Premiums, Deductibles, and More

When it comes to health insurance, the cost isn’t just around the premium (though that’s Chief too). You also want to look at how much you’ll pay when you need safety. Allow break it down:

- Premiums

This is the monthly cost you pay to have insurance. A plan with a low premium might appear like a good deal, but recall that it might come with great out-of-pocket costs when you need safety.

- Deductibles and Copays

Some plans have great premiums but lower deductibles and copays, which might save you money if you need a lot of safety. Other plans might have a lower premium but great deductibles, explication you’ll pay more upfront if something comes up.

- Out-of-Pocket Maximum

Look at the out-of-pocket maximum to see how much you’ll be expected to pay each year. Once you hit that amount, the insurance handles all your Health Insurance, so make sure that’s a quantity you’re enjoyable with.

A low every-month premium might sound nice, but it’s the overall costs (premium + superfluity + copayments) that will matter when you need safety. Take the time to look at all these numbers to make sure you’re getting a good value.

Check the Plan’s Network

One of the great factors to consider is whether your doctors and medical center are in-network. Here’s why that matters:

- In-Network of Friends

If your doctor is in the plan’s network, you’ll pay less for safety. Insurance companies make deals with friends to get lower prices for their members.

- Out-of-Network of friends

If you go outside the network, you’ll usually pay more. Some plans don’t handle any out-of-network safety at all, except in emergencies, so it’s the Chief to check.

Make sure your primary safety doctor and any professional you need are in the network. If you travel many times or live in multiple locations, look for a plan with a larger network or one that offers handling in multiple areas.

Think around additional profit.

A good health insurance plan doesn’t just handle doctor’s visits. Many plans offer additional profit that can make a great difference in your overall well-being. Some things to look for include:

- Preventive safety

Many plans handle things like annual check-ups, vaccines, and screenings at no additional cost to you. This can assist you in staying on top of your health and catching issue speedy.

- Mental Health Services

If you need counseling or therapy, check if the plan handles mental health services.

- Dental and Vision

Some plans include dental and vision safety, which can save you money if you need glasses or well-organized dental cleanings.

- Wellness Programs

Some plans offer discounts on gym memberships or offer help for things like burden loss or quitting smoking.

These additional perks can make a plan a lot more valuable, so don’t forget to factor them in when you’re comparing options.

Read analysis and Ratings.

Selecting a health insurance plan isn’t just around the numbers. It’s also around the expertise you’ll have with the company. Take a few minutes to read the analysis and ratings from other customers. Look for feedback on:

- Customer Service

Is the insurance company easy to work with? Do they respond to quizzes quickly and handle claims fairly?

- Claims Process

How easy is it to file a claim, and how quickly do they pay out?

- Satisfaction Ratings

Websites like J.D. Power and Consumer Reports offer ratings on health insurance companies. They can give you a good proposal of what to expect.

Reading analysis can give you a feeling of how well a company treats its buyer and whether you’ll be satisfied with their service.

Get assist If You Need It.

Selecting good health insurance can be complex, and it’s okay to ask for help. You don’t have to do it single! You can talk to:

- An Insurance Broker or Agent

These professionals can assist you in recognizing the details of dissimilar plans and guide you to a good option for you.

- A Financial Advisor

If you want assistance figuring out how a health plan is fixed into your financial plan, a financial advisor can offer valuable advice.

Don’t uncertain to ask quiz and get the assistance you need to make a good choice for you and your family.

Conclusion

Selecting a good health insurance plan doesn’t have to be a stressful expertise. By recognizing your health needs, knowing key time, comparing costs, and surveying the network, you can find a plan that works for you.

Take your time, read the analysis, and don’t be scared to ask for help. With a good plan, you’ll be handled and confident in your health safety choices.

FAQ

How do I have any idea which health insurance plan is great for me?

Assess your health safety needs, such as your health condition, medications, and doctor visits, to control the level of handling you need.

What are some common health insurance times I should recognize?

Familiarize yourself with time like premium (every monthly cost), superfluity (out-of-pocket before insurance pays), and copay (fixed fee per visit).

What are the dissimilar types of health insurance plans?

Selecting includes HMO (network needed), PPO (flexible, but great costs out-of-network), EPO (no out-of-network safety except emergencies), and POS (combined factor of HMO/PPO).

How do I compare the costs of middle health insurance plans?

Compare premiums, deductibles, copays, and out-of-pocket maximums to find a plan that fixes your financial plan and handling needs.