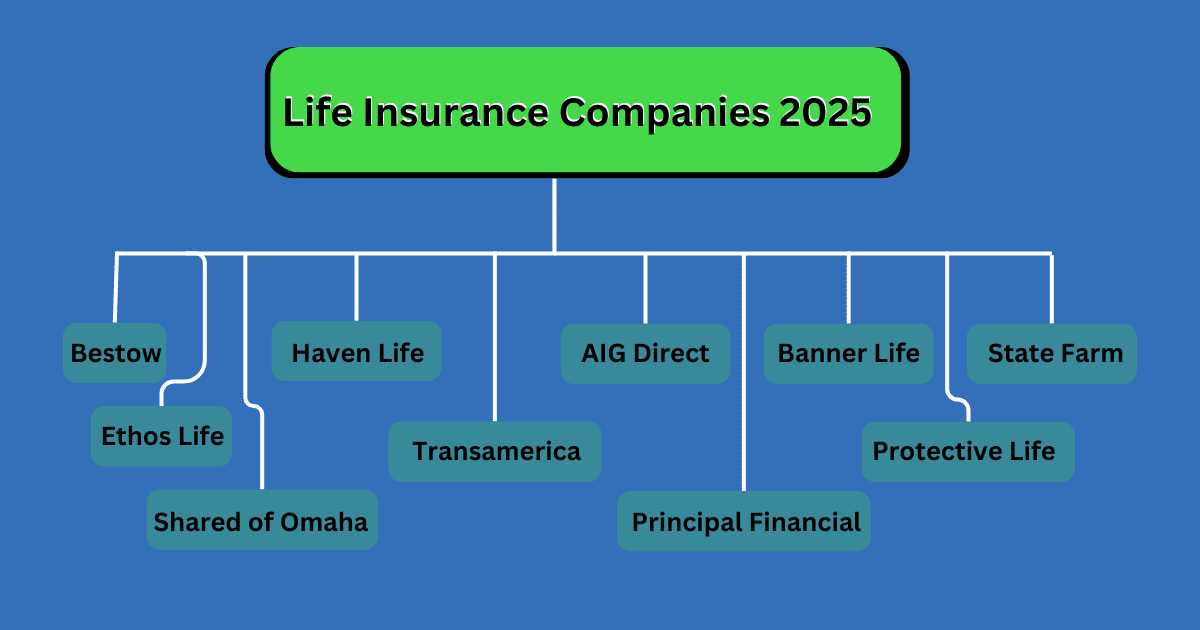

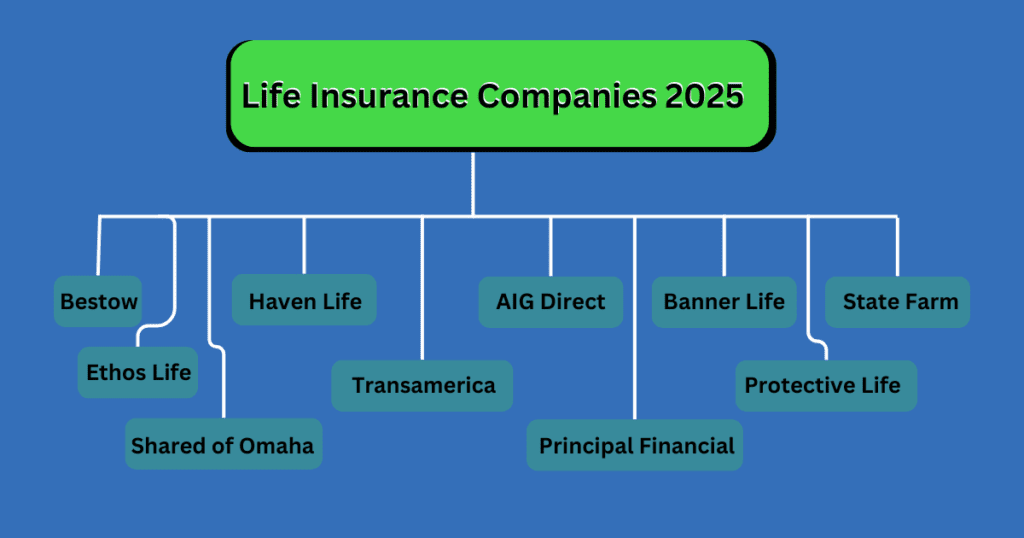

Suppose you want to protect your family. So you must have the Best Life Insurance Companies, But many people avoid it because they consider it expensive and wasteful.

Be happy! You can benefit from our help in getting life insurance that fits your budget. We will tell you about affordable and durable life insurance plans for 2025. In this article, we will enlighten you concerning the best and least expensive extra security organizations and rules.

We are here to assist you with finding the right extra security rules. We will suggest a live insurance plan that fits your budget.

1. Haven Life Best Life Insurance Companies

Overview

Haven Life is a popular choice for affordable term life insurance in 2025. Supported by the trusted insurance company MassMutual, Haven Life stands out for its good rates and easy, fully online process.

You can apply, get approved, and start your policy right from home, with no need to meet anyone in person.

Key Features

- Affordable Rates: Known for offering low premiums, especially for healthy applicants.

- Online Process: The entire application process is digital, making it fast and convenient.

- Instant Coverage: Some applicants receive immediate approval, so there’s no waiting period.

Why It’s Cheap

Haven Life’s digital app cuts costs. It can then offer lower rates than many traditional insurers.

Best For

Young families, individuals in good health, and anyone who prefers a fully online experience.

2. Ethos Life

Overview

Ethos Life is a well-known and reasonable decision. Clear disaster protection without the problem of clinical tests.

They offer term rules up to $1 million, which is great for families and people who need huge inclusion for a minimal price.

Key Features

- No Medical Exam: For most principles, you won’t require a clinical test, simply a speedy well-being poll.

- Flexible Terms: The internet-based process is quick and just requires around 10 minutes.

- User-Friendly Application: The web-based process is quick and just requires around 10 minutes.

Why It’s Cheap

By eliminating the medical exam and automating the underwriting process. Ethos keeps premiums low, making life insurance accessible to more people.

Best For: People looking for reasonable inclusion with negligible problems. Especially individuals who might be careful about customary clinical tests.

3. Bestow Life Insurance

Overview

The present is another computerized first firm. It offers cheap term life insurance without a medical exam.

With rules.Upheld by the North American Organization forever. Health care coverage, at present, provides financial security and a quick online process.

- Quick Approval: Get supported in just 5 minutes.

- Flexible Terms: rules range from 10 to 30 years.

- High Coverage Limits: Offers rules up to $1.5 million.

Why It’s Cheap

Bestow uses technology to process applications quickly, which lowers administrative costs and allows them to offer affordable rates.

Best For

Individuals who want quick, affordable coverage without having to go through a medical exam or lengthy approval process.

4. Banner Life

Overview

Flag Life is a life insurance firm. It has some of the lowest rates for term-life policies in the industry.

Flag Life is a good choice. It’s known for great client care and financial strength. If you want a budget plan with friendly coverage from a trusted provider, consider them.

Key Features:

- Competitive Rates: Among the lowest term life premiums in the industry.

- Adaptable Inclusion Choices: Rules from 10 to 40 years, with customizable terms.

- Convertible rules: Term rules can be converted to permanent coverage if your needs change.

Why It’s Cheap:

Banner Life focuses on affordability and provides Adaptable Inclusion Choices without sacrificing quality, which makes it a reliable and budget-friendly choice.

Best For:

People looking for low-cost, flexible term life rules with the option to convert to permanent coverage.

5. AIG Direct

AIG Direct offers durable life insurance at fair rates. It’s a flexible option for many financial plans.

AIG’s deep ties to the extra security market make it a trusted name. Its policies come with various riders for more customisation.

Key Features

- Low monthly premiums: competitive rates for both term and permanent policies.

- Flexible Policy Options: Choose from term, whole, and universal life insurance.

- Riders Available: Customize your policy with options like child protection and accidental death benefits.

Why It’s Cheap

AIG offers an extensive variety of strategy choices, making it simple to find reasonable charges for the particular inclusion you want.

Best For:

People looking for a mix of affordability and customization options, especially if they’re interested in permanent life insurance.

Pros and Cons of Modest Disaster Protection Organizations

| Pros | Cons |

| This moderation permits many individuals to get monetary assurance without overspending. | This is great for individuals who lean toward a problem-free encounter. |

| For those searching for a strategy that fills in as a venture or reserve funds vehicle. Term life may not address their issues. | Assuming you have explicit well-being needs. You could find less reasonable choices in no-test plans. |

6. Shared of Omaha

Overview

Common of Omaha is known for its financial plan accommodating term extra security and improved on entire life choices.

With a solid standing for consumer loyalty and scope of inclusion choices. Common of Omaha makes life coverage open to all mature gatherings.

Key Features:

- Affordable for Seniors:

Offers serious rates for seniors, going with it a top decision for more seasoned candidates. - No-Medical Exam Option:

Some term strategies don’t need a clinical test. - Flexible Terms:

Term rules are accessible from 10 to 30 years.

Why It’s Cheap

With its scope of no-test strategies and reasonable term choices. Shared of Omaha guarantees low expenses for candidates across various age gatherings.

Best For:

Seniors looking for affordable coverage or anyone who prefers a no-exam application process.

7. State Farm

Overview:

State Ranch is a well-known name. It offers a range of insurance products, including term life policies. State Ranch is famous for its great client care and custom approach. It is a top choice for those who want personal help.

Key Features:

- Personalized Service:

Access to local agents for guidance and support. - Affordable Term Policies:

Competitive rates for term life insurance. - Bundling Options:

Save more by bundling with other State Farm policies like auto or home insurance.

Why It’s Cheap

With the option to bundle policies and local agents who can find discounts. State Farm offers affordable solutions for customers seeking multiple lines of insurance.

Best For

Individuals who prefer working with a local agent may want to bundle multiple insurance products.

8. Transamerica

Overview

Transamerica is a major provider of term and whole life insurance. It offers competitive options. Their term policies are particularly affordable. Making them a popular choice for budget-conscious families and individuals.

Key Features:

- Low Premiums for Term Policies:

Competitive rates for term coverage. - Wide Age Range:

Presents arrangements to candidates to mature 80. - Flexible Coverage Amounts:

Approaches accessible with inclusion limits from $25,000 to $10 million.

Why It’s Cheap

Transamerica has flexible coverage and term options. It offers affordable solutions for many needs and ages.

Best For

Families and individuals looking for flexible term life options at competitive rates.

9. Protective Life

Overview

Defensive Life has gained notoriety for reasonableness, offering spending plans cordial terms and widespread life coverage strategies.

With direct strategy choices and low charges, it’s a decent decision for those searching for straightforward. Reasonable life coverage.

Key Features

- Low-Cost Term Policies:

Known for affordable term life options. - Customizable Coverage:

Choose term lengths and coverage to match your budget and needs. - Universal Life Options:

Protective also offers affordable universal life insurance for those wanting lifelong coverage.

Why It’s Cheap

Protective Life focuses on affordable term policies and offers flexibility for customizing coverage.

Best For

People seeking straightforward, affordable term or universal life insurance.

10. Principal Financial

Overview

Head Monetary offers reasonable term life insurance. It focuses on quick approvals.

They’re known for adaptable inclusion choices and the capacity to restore strategies after the underlying term closes. Which can be a decent decision for those preparing.

Key Features

- Streamlined Underwriting:

No medical exam is required for qualifying applicants. - Flexible Renewal:

Renew term policies even after the initial term, keeping costs low. - Various Coverage Amounts:

Policies for a range of budgets, from small to large death benefits.

Why It’s Cheap

Chief Monetary’s streamlined underwriting and flexible renewal options allow for budget-friendly policies over the long term.

Best For

People looking for adaptable, minimal expense term protection with reestablishment choices.

Conclusion

Finding sensible calamity insurance doesn’t mean you have to relinquish the quality or amicability of your mind.

The Best Life Insurance Companies of 2025 are arranged with versatility. Monetary plans and well-arranged decisions can help you without wasting every dollar.

FAQs

What is the least expensive sort of life insurance?

Term life insurance is ideal for people seeking affordable, straightforward coverage for a set period.

Could I, at any point, get reasonable life insurance without a clinical test?

Suppliers like Ethos Life, Offer, and Shelter Life work in reasonable, no-test choices, making getting inclusion rapidly and at a lower cost more straightforward.

Which life insurance organization is best for youthful families?

Haven Life and Ethos Life are popular among young families due to their affordable term

policies, easy online application process, and flexible coverage options.

Are modest life insurance approaches still dependable?

Choosing reputable companies ensures that even budget-friendly policies offer reliable coverage.

Could I, at any point, package extra security with different kinds of protection for limits?

This option is excellent for those looking to save on multiple insurance policies.