When many consider additional security, they picture a prosperity net for their friends and family. Expecting something to happen to you, Life Insurance gives money to help your loved ones with regulating without you. Nonetheless, did you have, in any event, some thought that Life Insurance could similarly be a splendid end devour instrument? Could we dive into how additional security capabilities are a theory and why it might justify considering your financial future?

What Is Life Insurance?

Inclusion is an arrangement between you and a protection office in its middle life. You pay a premium; thus, the association promises to pay a death benefit to your beneficiaries when you kick the bucket. This money can help care for everyday expenses, deal with commitments, or even resource a young person’s tutoring. It’s a technique to manage your loved ones when you’re mysteriously gone.

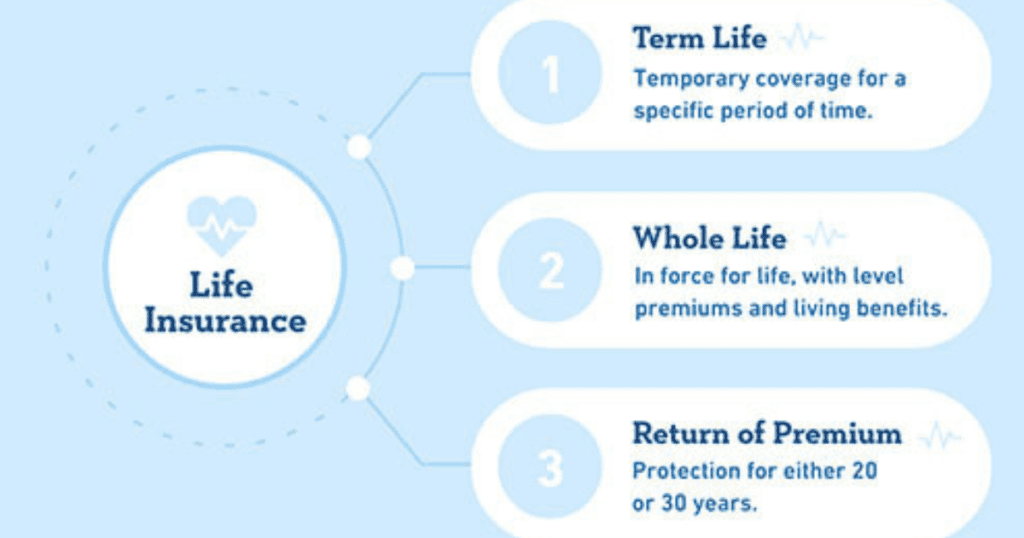

Types of Life Insurance

There are several types, each serving different needs.

1. Term Life Insurance

Term extra security is the least difficult choice. You purchase inclusion for a particular time frame — 10, 20, or even 30 years. Assuming you die during that period, your recipients get the payout. If you outlast the term, there’s no advantage. This type is usually less expensive and ideal for people who need inclusion for a specific phase of life, such as raising kids.

2. Whole Life Insurance

Entire disaster protection is a touch more mind-boggling. It covers you for as long as you can remember and incorporates a part of money esteem that develops over the long haul. You can acquire against this money worth or even money it in later. While it’s more costly, it offers long-lasting insurance and investment funds.

3. Universal Life Insurance

Widespread disaster protection adds adaptability. You can change your charges and demise advantages to meet your requirements. Like entire life, it assembles cash esteem. This choice is perfect for individuals who need more command over their approach.

4. Variable Life Insurance

Variable life insurance consolidates life inclusion with venture choices. You can esteem the money in stocks, securities, or shared reserves. This implies your money’s worth can develop or recoil in light of market execution. While it has the potential for development, it additionally conveys chances.

How Life Insurance Serves as an Investment Tool

Building Cash Value

One of the significant advantages of comprehensive extra security is money esteem. A portion of your premium goes into an investment account that develops over the long run. This can act as a secret stash or a method for collecting riches. If you want cash, you can acquire against this worth or withdraw it, giving you access to reserves when you want them most.

Tax Advantages

Life insurance offers some excellent tax reductions. The money esteem develops charge-free, meaning you don’t need to pay charges on it until you withdraw cash. Also, when you die, your recipients ordinarily get the demise benefit tax-exempt. This expense effectiveness can make life insurance an extremely engaging choice for creating financial well-being.

Guaranteed Returns

With entire life strategies, money esteem typically develops at a dependable rate. This gives a protected spot to store your cash, particularly for people who would rather not face challenges in financial exchange. Realising your money worth will consistently increment can bring an inward feeling of harmony.

Using Life Insurance in Estate Planning

Presently, we should discuss how extra security squeezes into home preparation. This is where it truly sparkles.

Covering Estate Taxes

When somebody dies, their domain might owe charges. This can remove a significant piece from what you need to abandon. Disaster protection can provide the assets expected to cover these charges, guaranteeing your beneficiaries don’t need to sell resources just to pay the bill.

Equalizing Inheritances

If you have numerous kids or beneficiaries, extra security can help you treat them similarly. For example, if one kid gets a family home, you can devise a strategy for another kid. That way, they get the demise benefit, offsetting the legacy.

Providing for Dependents

If you have wards—like children or a companion—extra security guarantees they’ll be dealt with after you’re gone. The demise benefit can cover everyday costs, schooling costs, and other monetary necessities, giving your friends and family a safety net.

Trust Funding

Life coverage can likewise subsidise a trust. This is particularly valuable if you have a more considerable bequest. You can name a trust as the recipient of your strategy. Upon your demise, the passing advantage goes straightforwardly into the trust, which can oversee and convey your resources per your desires.

Estate Planning Strategies with Life Insurance

Now that you understand how disaster protection can help your home preparation, let’s examine a few procedures.

1. Naming Beneficiaries

One of the main things you should do is name recipients for your life insurance strategy. These are individuals who will get the payout. It’s essential to stay current, particularly after significant life-altering events like marriage, divorce, or the introduction of a kid.

2. Setting Up an Irrevocable Life Insurance Trust (ILIT)

An ILIT can assist with eliminating life insurance from your available home. By moving your arrangement to an ILIT, the passing advantage won’t combine with your home. This can decrease home duties and guarantee more goes to your beneficiaries. Simply remember that once you set up this trust, you can’t transform it.

3. Using Life Insurance for Business Planning

Life coverage can safeguard your business’ worth if you’re an entrepreneur. Critical individual protection covers the deficiency of a significant worker, while purchase-sell arrangements supported by life insurance guarantee colleagues can purchase out a departed accomplice’s portion.

4. Charitable Giving

If you’re enthusiastic about a reason, consider naming a cause as a tour life insurance strategy. Recipient: Along these lines, you can leave an enduring inheritance while possibly acquiring tax reductions for your domain.

Factors to Consider When Using Life Insurance as an Investment

Cost of Premiums

While disaster protection can be considered speculation, be aware of the expense. Charges, particularly for entire and all-inclusive strategies, can be high. Guarantee that the instalments fit into your spending plan, and think about your drawn-out monetary objectives.

Understanding Policy Terms

Every approach has its terms, including expenses and limitations for cash esteem withdrawals. Make a point to peruse the fine print. Understanding your arrangement will enable you to make the best choices for your monetary future.

Long-Term Commitment

Extra security is ordinarily a responsibility. You want to stay with it and pay expenses for a long time. If you quit paying, you could lose your inclusion or have to deal with damages.

Financial Goals

Consider how life insurance fits into your overall monetary arrangement. It very well may be essential for a different speculation system. Offset it with other investments to spread your gamble and augment expected returns.

Pros and Cons of Using Life Insurance as an Investment

Pros

- Tax cuts: The money esteem develops charge conceded, and the death benefit is often tax-exempt for recipients.

- Cash Worth Development: Entire and widespread arrangements collect money esteem over the long run, giving reserve funds.

- Reliable Assurance: Offers long-lasting inclusion; it is monetarily secure to guarantee your friends and family.

- Monetary Security: Gives inner harmony, realising your family is safeguarded.

Cons

- High Expenses: Long-lasting arrangements can be exorbitant, probably not accommodating everybody’s financial plan.

- Intricacy: Extra security can be convoluted. It is essential to Grasp agreements.

- Potential for Misfortune: Assuming you pull out cash esteem, it might decrease your passing advantage.

- Long haul Responsibility: Requires a drawn-out monetary responsibility, which may not suit everybody.

Conclusion

Extra security is often seen as a wellbeing net. However, there tends to be quite a lot more. It can act as a significant speculation device, assisting you with building cash esteem while guaranteeing your friends and family are safeguarded. Understanding how linsurancences squeeze into your monetary and home arrangements can enable you to make informed choices for your future. Disaster protection is fundamental to numerous monetary systems, whether accommodating your family, covering charges, or leaving an inheritance.

FAQs

Could life insurance, at any point, be utilised as a venture?

Indeed, specific kinds of disaster protection, similar to entire and widespread life, have cash esteem parts that can develop over the long run.

How does disaster protection assist with home preparation?

Life coverage can cover bequest charges, level legacies, and accommodate wards, making it a significant device in domain arranging.

What is a Permanent life insurance Trust (ILIT)?

An ILIT is a trust that holds your extra security strategy, keeping it out of your available home and dealing with the passing advantage for your recipients.

Might I, at any point, change my recipients on my extra security strategy?

Indeed, you can refresh your recipients as your life conditions change. Keeping this data current is significant.

Is life insurance a wise venture for everybody?

Life coverage can be wise for some, particularly those with wards or explicit domain arranging needs. Evaluate your situation and objectives to determine what’s best for you.