Full Life insurance is an integral component of financial planning. Full life (insurance) coverage is one of the most widespread plan designs in providing life-long protection and peace of mind-that is, to achieve life-long security. When first encountered, this guide will help you understand, what are, the basics, the advantages, and why it is a suitable solution for you.

In this comprehensive yet understandable post, we’ll address the most frequently asked issues concerning complete life insurance. First, let’s discuss what complete life insurance is. A Beginner’s Guide and answer any questions that you might have.

What is Full Life Insurance?

Full life insurance (also called whole life insurance) is a type of insurance that does not restrict coverage to a defined period. In contrast to term life insurance, which is valid only for a certain time, whole life insurance will be valid as long as a beneficiary makes the premium due.

Besides paying out cash value to insured persons, full life insurance accumulates cash value in the course of time. Insurance coverage based on a financial product is a specialization of insurance coverage.

How Does Full Life Insurance Work?

Buying a whole life insurance policy you have to pay regular premiums. Premiums for this type of insurance are typically higher than premiums for term insurance, but they are also borne by insurance company costs and cash value policy payments.

Cash value accumulates over time usually at a yield that is fixed. You can borrow against, withdraw, and, if necessary, sell it for the cash value.

Key Features of Full Life Insurance:

Lifetime Coverage: As long as premiums are paid regularly, this policy will be in effect for the remainder of your life.

- Cash Value Growth: A portion of the premium is accrued cash value.

- Fixed Premiums: Prescriptions are stable in the policy term.

- Death Benefit: Offers a terminable death benefit guaranteed to your beneficiaries, as of your death.

Who Should Consider Full Life Insurance?

Full life insurance is not for everyone, but it is a potential solution in some instances. Here are some cases where it might make sense:

- You Want Lifetime Coverage: Full life insurance is the safest option for a family to receive a guaranteed income regardless of when its members die.

- You’re Looking for a Financial Asset: The cash value element, in the form of savings, is, however, in a position to be a tool of financial liquidity in the future.

- You Have Estate Planning Needs: Full life insurance, in addition to meeting the financial requirements of grieving beneficiaries, can also help to cover estate taxes, and it can leave your beneficiaries a legacy.

- You Prefer Fixed Premiums: Unlike term insurance, which may increase in cost at renewal, full lifetime insurance premiums are fixed.

Benefits of Full Life Insurance

Full life insurance offers several advantages that make it appealing for long-term financial planning:

1. Lifetime Protection

Your insuring period is to the extent that you keep on paying your premiums. Not only this, there is peace of mind as well as financial benefits for your family.

2. Cash Value Growth

Money value grows at a steady rate, and the product is converted into the financial of the asset which can be used in case of emergencies or anticipatory purposes.

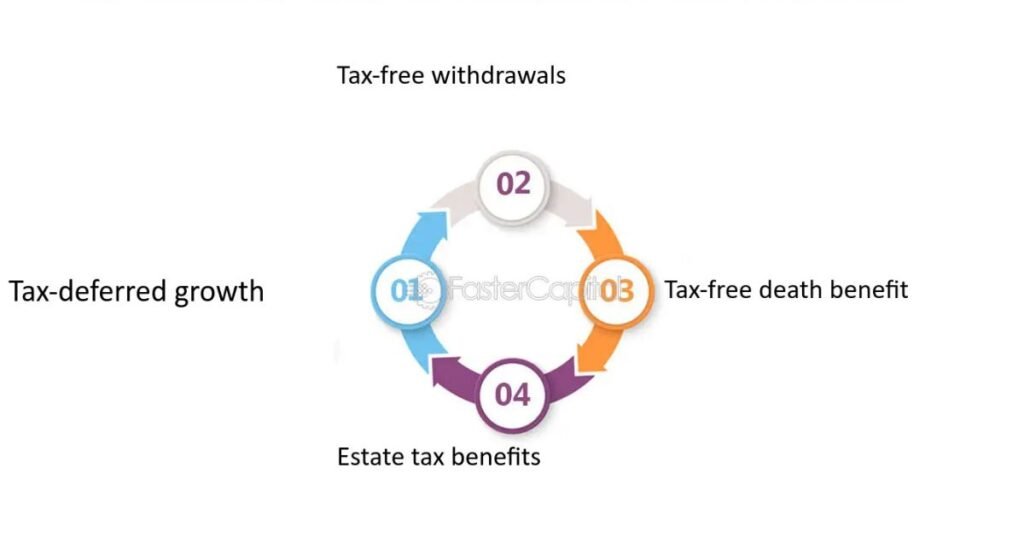

3. Tax Advantages

Cash value builds up tax-deferred so that income tax is not paid on its growth until it is taken out. Additionally, recipients usually do not pay taxes on death benefits.

4. Predictable Costs

When you have fixed premiums, you will always be aware of your payment amount. This can, in turn, help to make budget planning more sensible and therefore predictable.

5. Customizable Options

Whole life insurance policies can be equipped with riders which allows the policyholder to adjust insurance coverage. Active riders consist of disability waiver, lifetime care benefit, and early-pass beneficiary death benefit.

Drawbacks to Consider

While full life insurance has many benefits, it’s important to weigh the potential downsides:

- Higher Premiums: Full (whole) life insurance is more expensive than term life insurance, and not beneficial to all users’ pocketbooks.

- Complexity: Cash value and the other policy elements alone can render whole life insurance unintelligible to the point of being bewildering.

- Lower Returns: Cash value growth, as a whole, is, typically, smaller than asset returns from stock or mutual fund investments.

Full Life Insurance vs. Term Life Insurance

To understand What is Full Life Insurance? A Beginner’s Guide is helpful to compare it with term life insurance:

| Feature | Full Life Insurance | Term Life Insurance |

| Coverage Length | Lifetime | Specific terms (e.g., 10, 20 years) |

| Premiums | Higher and fixed | Lower, but can increase upon renewal |

| Cash Value | Builds cash value | No cash value |

| Best For | Long-term planning, estate needs | Short-term coverage needs |

How to Pick the Best Policy for Full Life Insurance

The process of selecting a comprehensive life insurance coverage might be intimidating. The following advice will help to streamline the process:

- Evaluate Your Needs: Take into account your long-term ambitions, family circumstances, and financial objectives.

- Compare Providers: Discover high-quality insurers with great financial ratings and good reviews from customers.

- Understand the Costs: Understand the high rates, fees, and the potential for cash value return.

- Ask About Riders: Ask about any potential additional features or riders that could be included in your policy.

- Consult an Expert: A financial planner or insurance salesperson can guide you to the applicable coverage for your situation.

Common Myths About Full Life Insurance

1. It’s Too Expensive.

Although complete life insurance is more expensive, from a perspective of long-term cost and cash value growth, it might be advantageous to invest in it.

2. It’s Only for the Wealthy.

Permanent insurance is of interest to everyone who wants to have lifelong continuous coverage and financial security, no matter what they earn.

3. It’s Not a Good Investment.

Even with the potential drawbacks being lower than replacements, whole life insurance offers stability, security, and taxation.

Tips for Maximizing Your Full Life Insurance Policy

- Pay Your Premiums On Time: This ensures your coverage remains active and avoids penalties.

- Monitor Your Cash Value Growth: Regulate the cash value and its growth and consider the best way to deploy it.

- Review Your Policy Regularly: Changes in life such as marriage or parenthood may involve a change of cover.

Conclusion

Lifelong insurance is an effective tool for people wishing to have lifelong insurance and wealth security. By understanding What is Full Life Insurance? In this Beginner’s Guide, you are in a position to make an informed decision on whether this kind of policy is suitable for you.

Full life insurance provides, not only for the deceased but also a safety net that is more than just, not only, a safety net. It’s a long-term investment in your financial future.

Whatever your experience level with life product insurance or wanting to improve your protection, considering whole life insurance coverage has great potential to bring peace of mind and lifetime benefits. For this purpose, it can be worthwhile today to consider, on the one side, oneself and, on the other side, to look at the present regulation, and to discuss the future that is to be.

FAQs

1. What is full life insurance?

A full life is a policy that covers a lifetime of benefits and the cash value is accumulated over time. It affords financial security to your dependents, as well as a capacity reserve.

2 What distinguishes full life insurance from term life?

Full life insurance offers lifetime coverage plus a cash value component, in contrast to term life insurance, which has a set duration.

3. Is full life insurance a good investment?

The terminal life insurance (whole-life) plan provides a whole-life plan (long-term) plan that includes the advantages of pure life protection, tax exemption, and cash appreciation, which are a viable option in the context of insurance financial planning.

4. Who should consider buying full life insurance?

Whole Life is appropriate for those wishing for a lifetime of insurance, a utility for estate planning applications, and a product combining medical insurance and savings.

5. What are the main benefits of full life insurance?

Time insurance “whole life insurance” has accrual features for the guaranteed premium, tax-sheltered cash value, and a guaranteed death benefit.