Life insurance is one of the most important savings you can make for your family’s budgetary Safety. It makes sure that your loved ones are protected and can maintain their standard of living in your absence. However, with so many life insurance companies available, choosing the right one can feel very big.

How do you make sure you’re picking a Believable supplier that will stand by their promises when your family needs them most?

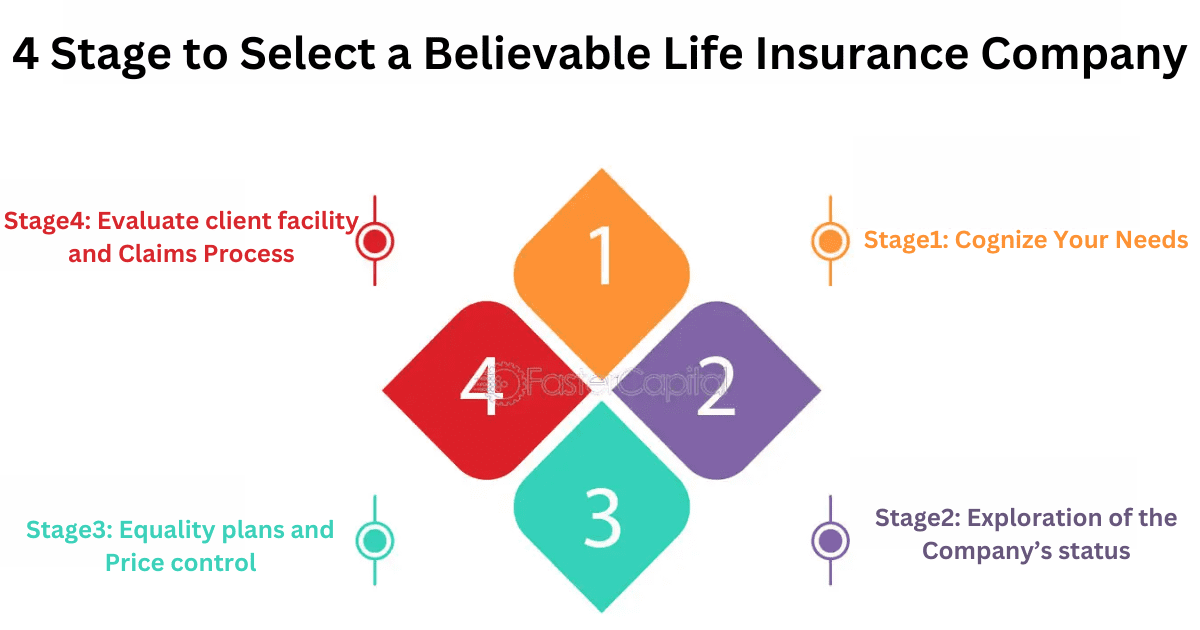

The activity doesn’t have to be Difficult. Pay attention. On four key stages—thoughtful of your needs, exploring the company’s status, Equality plans, and Marking client facility—you can surely select an Insurance that fits your Needs.

A Believable life insurance company not only offers Perfect handling at a fair cast but also transfer brilliant facility and handles claims In a good way.

This leader will walk you through every one of these actions in explaining, making it easy for you to make a to-tell solution.

Whether you’re new to life insurance or re-marking your selections, these tips will support you find a reliable company to save your family coming.

Stage1: Cognize Your Needs

Before falling into the exploration for a life insurance company, it’s important to symbolise what you’re looking for in a plan.

This will support you small down your selections and effort on suppliers that align with your goals.

Determine Your Handling Amount.

The handling amount depends on several factors like your income, debts, and coming budgetary goals. Think about:

- How much money your family would need to relieve day-to-day active charges in your absence?

- Excellent debts, such as mortgages or car loans.

- Long-duration goals, like college tuition for your kids or a spouse’s retirement fund.

Select the Type of Life Insurance

Life insurance plans commonly fall into two main types:

- Duration Life Insurance:

Offers handling for a set date, such as 10, 20, or 30 years. It’s more cheap but doesn’t build cash value.

- full Life Insurance

Offers lifelong handling with a savings component that grows over time. It’s more expensive but can serve as a Savings.

Deciding which type fits your needs will help you filter out insurers that don’t offer the right selections.

Study Additional Features

Some life insurance plans contain conditions—elective add-ons that increase your handling.

Examples include:

- Serious Disease conditions

Offer budgetary support if you’re identified with a simple Disease.

- Mishap Death Benefits:

Offer additional payouts if death occurs due to a mishap.

- Discount of Best

This lets you disable best payments if you become Disabled.

Having a clear thought of your needs makes sure you’ll only study companies that offer plans with the right features.

Stage2: Exploration of the Company’s status

Not all life insurance suppliers are created equal. Investigating the status of potential companies can save you from coming headaches.

Check budgetary Strength Ratings

The budgetary fitness of a life insurance company matters as it fixes whether it can pay claims reliably, even through financial falls.

Rating agencies like AM Best, Moody’s, and Usual & Poor’s judge the budgetary Peace of insurers. Look for companies with high rankings (e.g., “A” or well).

Read Client Reviews

client reviews can give you valuable insights into a company’s client facility, claims process, and overall reliability. Look for reviews on:

- Third-party websites like Trustpilot or the Better Business Bureau (BBB).

- Consumer forums and social media platforms.

Check for Complaints

Regulatory organizations like the National Association of Insurance Commissioners (NAIC) Offer data on complaints filed by Opponent insurers. An important amount of unsolved complaints is a red flag.

Ask for References

Friends, family members, or budgetary advisors may have personal experiences or insights about specific life insurance companies. Don’t hesitate to ask for their put-in.

Stage3: Equality plans and Price control

Once you’ve identified a few reliable companies, it’s time to evaluate their plans and pricing. Equality selections help you find the best value without sacrificing reliability.

Request Quotes

Many insurers offer free online tools to generate quotes based on your age, health, and handling preferences. Take advantage of these to gather pricing information.

Compare handling selections

Don’t just effort on the price. Examine the explanation of every plan, such as:

- The handling amount.

- The length of the Duration (if it’s Duration life insurance).

- Additional benefits or conditions are included.

A slightly higher Best might be worth it if the plan includes valuable features that align with your needs.

Cognize the Underwriting Process

The underwriting activity fixes your eligibility and Best rates. Companies vary in their underwriting criteria, which might include:

- A medical exam.

- A review of your fitness history.

- Lifestyle factors like smoking or risky hobbies.

Some insurers offer no-exam plans, but these often come with higher Bests. Study what’s most convenient for you.

judge Flexibility

Life changes and your insurance plan should adapt when needed. Look for:

- The ability to increase or decrease handling.

- Convertible plans (e.g., Duration to full life).

- Selections to disable or skip payments in special circumstances.

Stage4: Evaluate client facility and Claims Process

The greatest life insurance company is one that supports you every stage of the way—from buying a plan to filing a claim.

Test client Support

Reach out to the company’s client facility team with questions before you buy. Pay attention to:

- How quickly they respond.

- Whether they Offer clear and helpful answers.

- Their willingness to accommodate your needs.

This gives you a sense of how they’ll handle coming interactions.

Reexploration of the Claims Process

Filing a claim is the moment of truth for any life insurance plan. A Believable company should have a straightforward and fair process. Look for:

- An easy-to-cognize claims filing procedure.

- Digital tools for submitting and tracking claims.

- A history of paying claims promptly and without unnecessary disputes.

Explore Online Resources

Bonus Tips for Choosing the Right Insurer

Don’t Just Chase the Lowest Price

It’s tempting to select the cheapest plan, but reliability and Perfect handling are more important. A low-cost supplier that fails to pay claims won’t serve your family’s needs.

Bundle plans for Discounts

If you already have home, auto, or fitness insurance with a supplier, check if they offer discounts for bundling life insurance.

Work with an Independent Insurance Agent

Agents can support you compare selections from multiple insurers and lead you toward the best choice based on your unique needs.

Conclusion

Choosing a Believable life insurance company is a Serious solution that impacts your family’s budgetary Safety for years to come.

By following the four actions outlined here—thoughtful of your needs, exploring a company’s status, Equality plans and prices, and Marking client facility—you can make an tell choice with confidence.

Remember that Believable life insurance is not just a product; it’s a promise of protection. Prioritize companies with strong budgetary ratings, brilliant client reviews, and a transparent claims process. While affordability is important, reliability and Perfect handling are even more important when it comes to safeguarding your family’s coming.

Take your time to gather quotes, ask questions, and seek recommendations. If needed, study working with an independent insurance agent to compare your selections and clarify complex terms.

Ultimately, the right life insurance company meets your unique needs, treats you with respect, and stands by its commitment when your family needs it most.

By being thorough and deliberate in your solution-making process, you’ll find a supplier you can trust with the responsibility of protecting what matters most.

FAQs

Why is it important to select a Believable life insurance company?

A Believable life insurance company make sure your family receives the budgetary support they need when you’re no longer there. It Offers peace of mind by honouring claims and offering consistent facilities over time.

How do I determine the right handling amount?

Calculate your handling needs by considering your family’s living expenses, excellent debts, and coming budgetary goals, such as your children’s education or your spouse’s retirement.

What’s the difference between Duration and full life insurance?

- Duration Life Insurance

Offers handling for a set date (e.g., 10, 20 years). It’s cheap but doesn’t build cash value.

- Full life Insurance:

Offers lifelong handling with a cash value component that grows over time but comes with higher Bests.

How can I check a life insurance company’s status?

Look at budgetary strength rankings from agencies like AM Best or Moody’s, read client reviews, and check for complaints through regulatory organizations like the NAIC.

How do I compare life insurance plans?

Request quotes from multiple companies, compare handling amounts, conditions, and Best costs and evaluate every supplier’s flexibility and underwriting Needs.